Reflections with Rick Melero

REFLECTIONS Photo by Elise Zimmerman In a world often driven by the survival-of-the-fittest mentality, the teachings of the Bible stand out as a beacon of wisdom that, at first glance, may seem counterintuitive. However, upon closer examination, we find a fascinating harmony between these “kingdom laws” and the rational outcomes supported by scientific, psychological, and […]

HOLD ON TO YOUR ASS-ETS

By Sam Ally Here we are again, doomsday scenario looming, investors scrambling while others sit back like the cat that ate the canary. It’s in our faces everyday, you just can’t get away from it. They say stay off all media outlets, don’t pay attention to that crap, just keep your eyes on […]

The 2023 Hangover

The pandemic driven home buying frenzy, cheap debt and an insatiable urge to move certainly created one hell of a profit cocktail for investors. However, the year ahead may very well seem like the morning after, though it will take more than alka seltzer, a cheeseburger & shake to get rid of the hangover. 2023 […]

Perspective

With the midterms nearing a conclusion, we can all get back to normal, whatever that may be. On the surface, one thing seems certain, Wall Street will be making money. Markets rarely react well to uncertainty, so the political gridlock that happens with a power split (House vs Senate) is normally a favorable/market friendly outcome […]

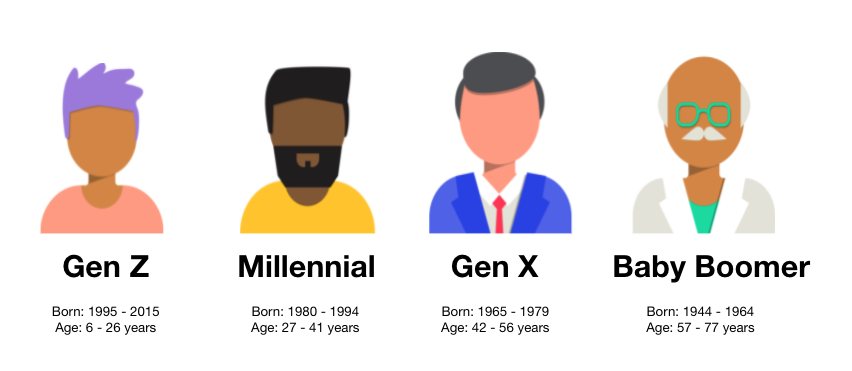

Greatest Transference of U.S. Wealth

$73 Trillion will be in Play An historic transfer of U.S. wealth will take place over the next two decades as millennials and Gen Zers are expected to inherit $73 trillion from the baby boomer generation. According to a Bank of America Private survey those set to inherit this money are poised to make different […]

Who’s Who In The World Of Lending

Private lender: Any non-depository individual or entity that primarily originates business-purpose loans secured by hard assets, generally real estate. Hard money lender: A subset of private lender where creditworthiness is determined solely by the securing real estate collateral. Correspondent lender: A subset of private lender where the closed loan is sold to investors. […]

Avoiding an IRS or State Audit

IRS enforcement is increasing and it’s critical to know how to avoid an Audit. With the passing of the Inflation Reduction Act, the IRS was given an 80 billion budget increase, essentially doubling the size of the IRS. If you didn’t think there was a target on your back, there is now. As many of […]

Building Alliances to Scale Your Business

Building alliances with other professional teams and groups of like mind is a key component in scaling your business quickly. Rick Melero sits with partner and investor Matt Kelsey of Deployed Capital Group discussing a recent six-figure profit opportunity. Video Transcript Rick: Hey guys, Rick Melero here with His Capital and I’m here today […]

Creating Equity: Infill Lots

When demand is high and supply is low you take a deep dive into the playbook to find the right play for the current cycle. Rick Melero is on the road cruising through one of the country’s hottest markets providing an inside look into some of the strategies the team is focusing on this year. […]

Semi-Custom Homes with Rick & Dolmar

Understanding the why, the strategy and how to implement that strategy. The market cycle dictates the strategies we employ to stay ahead of volatile market conditions. Rick spends time walking a new project with operating partner and Fund 3 investor Dolmar Cross and discussing the unique concept of semi-custom home building which was fueled by […]