In many parts of the US, $1 million in retirement money won’t even last 20 years. Estimates on healthcare costs from Vanguard project that a typical 65-year-old retired couple will spend $197,000 in healthcare expenses alone during their retirement, or just about 30% of what the typical 60-something has saved.

According to a survey by Charles Schwab conducted in 2019, the average American felt that they’d need to save $1.7 million to retire comfortably. But getting to that point is harder than it sounds.

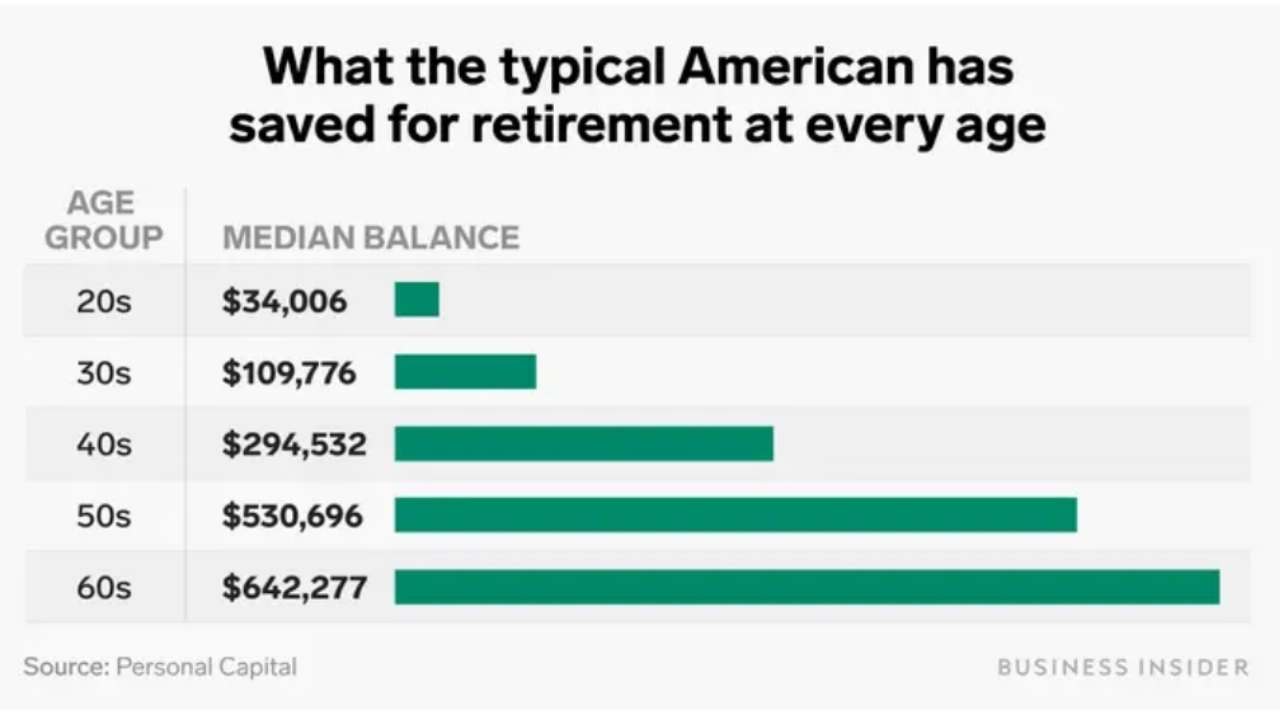

Millennials seem to be getting a good start on their savings, with Personal Capital’s typical 20-something client carrying a balance of about $34,000 in their retirement accounts. Between ages 20 and 49, account balances nearly triple for every 10-year age bracket.

According to a 2019 survey from Morning Consult and Insider, over 45% of millennials have a retirement account. Starting early is especially important when it comes to retirement, because one of the biggest factors that helps retirement savings grow is compound interest, where money saved generates interest on itself. The more years this process has to work, the more savings will grow.

While millennials are doing well with their saving, the older generations seem to have slowed down, and this might leave them with less than they thought in retirement. The typical 60-something has just over $642,000 saved, which sounds like a lot of money until you realize it might have to support you for the rest of your life.

Even for a couple who shares living expenses on two retirement accounts, the combined amount falls over $330,000 short of the amount they’d need to live on $65,000 per year.

In many parts of the US, $1 million in retirement money won’t even last 20 years. And estimates on healthcare costs from Vanguard project that a typical 65-year-old retired couple will spend $197,000 in healthcare expenses alone during their retirement, or just about 30% of what the typical 60-something has saved.

Market volatility is always a source of concern and often causes those who feel the need to “catch -up” to take on riskier investments with the hope of greater reward. That plan often backfires, but if you do feel the “itch” to gamble a little more than normal, make sure you have a hedge to offset potential losses. We can help, visit www.hisfund3.com and add tangible diversification to your investment plans.

На данном сайте вы можете приобрести онлайн мобильные номера разных операторов. Эти номера могут использоваться для регистрации профилей в различных сервисах и приложениях.

В ассортименте представлены как постоянные, так и одноразовые номера, что можно использовать чтобы принять сообщений. Это простое решение если вам не желает использовать личный номер в сети.

арендовать номер телефона

Процесс покупки очень простой: определяетесь с подходящий номер, оплачиваете, и он становится готов к использованию. Попробуйте сервис уже сегодня!

На этом сайте собрана полезная информация о терапии депрессии, в том числе у пожилых людей.

Здесь можно найти способы диагностики и подходы по восстановлению.

https://www.solverdce.ru/index.php/20200119/hello-world/?unapproved=192331&moderation-hash=d6ddfdb0762d5919739914d998e73506#comment-192331

Отдельный раздел уделяется психологическим особенностям и их влиянию на эмоциональным состоянием.

Также рассматриваются современные терапевтические и психологические методы поддержки.

Материалы помогут разобраться, как правильно подходить к угнетенным состоянием в пожилом возрасте.

Центр ментального здоровья — это пространство, где любой может получить помощь и профессиональную консультацию.

Специалисты работают с различными проблемами, включая стресс, усталость и депрессивные состояния.

http://sunshinehomehealth.net/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Fpreparations%2Fd%2Fduloksetin%2F

В центре используются эффективные методы лечения, направленные на улучшение эмоционального баланса.

Здесь создана безопасная атмосфера для доверительного диалога. Цель центра — поддержать каждого клиента на пути к психологическому здоровью.

Сертификация продукта необходима для выхода на рынок. Она помогает создаёт положительную репутацию компании. Товары с сертификатом часто является обязательным условием для сотрудничества с крупными партнёрами. Кроме того, наличие сертификата помогает избежать штрафов. Следует учитывать, что разные отрасли требуют различных видов сертификации.

сертификация качества

На этой платформе можно изучить статьями о стиле. Мы постоянно обновляем интересные материалы, чтобы вам было проще следить за миром моды.

Мы предлагаем разборы модных показов, а также советы по стилю. Следите за модой вместе с нами!

http://forum.l2endless.com/showthread.php?tid=519884

На этом сайте вы можете найти последние новости из мира автомобилей.

Информация обновляется регулярно, чтобы держать вас в курсе всех важных событий.

Новости авто охватывают все аспекты автомобильной жизни, включая новые модели, технологии и мероприятия.

http://www.pressreleasepost.com

Мы следим за всеми новыми трендами, чтобы предоставить вам самую свежую информацию.

Если вы интересуетесь автомобилями, этот сайт станет вашим надежным источником.

Предоставляем прокат автобусов и микроавтобусов с водителем большим организациям, бизнеса любого масштаба, а также частным заказчикам.

Доставка сотрудников на работу

Обеспечиваем комфортную и безопасную поездку пассажиров, предусматривая поездки на бракосочетания, корпоративные встречи, экскурсии и любые события в Челябинске и Челябинской области.

Предлагаем транспортные услуги с автобусами и микроавтобусами корпоративным клиентам, компаний среднего и малого сегмента, а также частным заказчикам.

Автобус на корпоратив

Организуем приятную и спокойную доставку пассажиров, предоставляя транспортные услуги на торжества, корпоративы, групповые экскурсии и все типы мероприятий в Челябинске и Челябинской области.

We offer a comprehensive collection of certified medicines for various needs.

Our platform guarantees speedy and safe order processing to your location.

Each medication is supplied by trusted pharmaceutical companies so you get safety and quality.

Feel free to explore our catalog and place your order hassle-free.

If you have questions, Our support team will guide you at any time.

Prioritize your well-being with our trusted e-pharmacy!

https://www.apsense.com/article/842691-is-shrimp-high-in-cholesterol-the-complete-evidence-based-guide.html

Оформление сертификатов в нашей стране по-прежнему считается неотъемлемым процессом выхода продукции на рынок.

Этот процесс подтверждает соответствие установленным требованиям техническим регламентам и законам, что, в свою очередь, защищает покупателей от некачественных товаров.

сертификация качества продукции

Также сертификация помогает взаимодействие с партнерами и открывает конкурентные преимущества в предпринимательской деятельности.

Без сертификации, возможны юридические риски и сложности при ведении бизнеса.

Таким образом, официальное подтверждение качества не просто формальностью, но и важным фактором укрепления позиций бизнеса в России.

Despite the widespread use of modern wearable tech, classic wristwatches are still everlasting.

Many people still appreciate the intricate design behind mechanical watches.

Unlike digital alternatives, that need frequent upgrades, mechanical watches hold their value for decades.

https://thungthoeng.go.th/forum/suggestion-box/37804-how-do-you-feel-about-patek-philippe-watches-do-t

High-end manufacturers continue to release limited-edition mechanical models, confirming that demand for them remains strong.

To a lot of people, a mechanical watch is not just a fashion statement, but a tribute to craftsmanship.

While smartwatches offer convenience, traditional timepieces carry history that never goes out of style.

Наш сервис занимается сопровождением иностранных граждан в СПб.

Мы помогаем в получении документов, регистрации, а также вопросах, касающихся работы.

Наши специалисты разъясняют по миграционным нормам и подсказывают правильный порядок действий.

Помогаем в оформлении ВНЖ, и в вопросах натурализации.

С нами, ваша адаптация пройдет легче, избежать бюрократических сложностей и спокойно жить в Санкт-Петербурге.

Пишите нам, чтобы узнать больше!

https://spb-migrant.ru/

BlackSprut – платформа с особыми возможностями

Платформа BlackSprut вызывает интерес разных сообществ. Почему о нем говорят?

Данный ресурс предлагает разнообразные опции для тех, кто им интересуется. Оформление системы выделяется простотой, что делает его интуитивно удобной даже для новичков.

Стоит учитывать, что этот ресурс работает по своим принципам, которые делают его особенным на рынке.

Говоря о BlackSprut, стоит отметить, что многие пользователи выражают неоднозначные взгляды. Некоторые отмечают его возможности, а некоторые оценивают его более критично.

В целом, данный сервис остается темой дискуссий и вызывает внимание разных пользователей.

Ищете рабочее ссылку БлэкСпрут?

Хотите найти актуальное зеркало на БлэкСпрут? Мы поможем.

bs2best at

Иногда ресурс меняет адрес, поэтому приходится искать актуальное зеркало.

Свежий адрес всегда можно узнать у нас.

Посмотрите актуальную ссылку у нас!

На данном ресурсе можно найти свежие новости мировой политики. Ежедневные публикации позволяют оставаться в курсе главных новостей. На сайте публикуются решениях мировых лидеров. Экспертные мнения помогают глубже понять ситуацию. Будьте в центре событий с этим ресурсом.

https://justdoitnow03042025.com

Поклонники онлайн-казино всегда могут найти актуальное обходную ссылку игровой платформы Champion и продолжать играть любым игровым ассортиментом.

На сайте можно найти различные слоты, от олдскульных до новых, а также новейшие разработки от топовых провайдеров.

Если официальный сайт временно заблокирован, зеркало казино Чемпион поможет обойти ограничения и наслаждаться любимыми слотами.

https://casino-champions-slots.ru

Весь функционал остаются доступными, начиная от создания аккаунта, депозиты и вывод выигрышей, и акции для игроков.

Используйте актуальную зеркало, и наслаждаться игрой без блокировок!

Health informatics uses technology to manage health information effectively. Understanding how electronic health records (EHRs) work impacts patient care. Learning about patient portals provides access to personal health data. Awareness of data privacy and security in health tech is crucial. Knowing how data analytics influences medical preparations and research is relevant. Finding reliable information on navigating digital health tools is helpful. The iMedix podcast discusses the intersection of health and technology. It’s a health news podcast covering innovations like health informatics. Tune into the iMedix health news features for digital health updates. iMedix: podcast content explaining modern healthcare tools.

Suicide is a complex phenomenon that impacts millions of people worldwide.

It is often connected to emotional pain, such as bipolar disorder, stress, or chemical dependency.

People who struggle with suicide may feel trapped and believe there’s no other way out.

how-to-kill-yourself.com

Society needs to spread knowledge about this topic and support those in need.

Prevention can save lives, and finding help is a brave first step.

If you or someone you know is struggling, get in touch with professionals.

You are not forgotten, and help is available.

На этом сайте вы можете наслаждаться большим выбором игровых слотов.

Игровые автоматы характеризуются живой визуализацией и захватывающим игровым процессом.

Каждый игровой автомат предоставляет особые бонусные возможности, увеличивающие шансы на выигрыш.

1xbet казино официальный сайт

Игра в игровые автоматы предназначена игроков всех уровней.

Вы можете играть бесплатно, после чего начать играть на реальные деньги.

Испытайте удачу и насладитесь неповторимой атмосферой игровых автоматов.

This portal provides access to a large variety of slot games, suitable for both beginners and experienced users.

On this site, you can explore retro-style games, feature-rich games, and progressive jackpots with stunning graphics and immersive sound.

If you are a fan of minimal mechanics or love complex features, you’re sure to find what you’re looking for.

https://1alimenty.ru/wp-content/pag/kakoe_postelynoe_belye_budet_horosho_smotretysya_v_komnate_podrostka.html

Each title is playable around the clock, no download needed, and fully optimized for both PC and mobile.

In addition to games, the site provides slot guides, bonuses, and community opinions to guide your play.

Register today, jump into the action, and get immersed in the world of digital reels!

This website provides access to plenty of video slots, designed for both beginners and experienced users.

Here, you can discover retro-style games, new generation slots, and jackpot slots with high-quality visuals and realistic audio.

Whether you’re into simple gameplay or seek engaging stories, you’re sure to find something that suits you.

https://telegra.ph/Plinko-v-kazino-Vse-chto-nuzhno-znat-ob-igre-i-eyo-demo-versii-03-15

All games are available anytime, no download needed, and well adapted for both desktop and smartphone.

Apart from the machines, the site provides helpful reviews, special offers, and player feedback to help you choose.

Sign up, jump into the action, and get immersed in the thrill of online slots!

Здесь вам открывается шанс играть в широким ассортиментом игровых слотов.

Слоты обладают яркой графикой и интерактивным игровым процессом.

Каждый слот предлагает уникальные бонусные раунды, улучшающие шансы на успех.

1win casino

Игра в слоты подходит игроков всех уровней.

Есть возможность воспользоваться демо-режимом, после чего начать играть на реальные деньги.

Проверьте свою удачу и получите удовольствие от яркого мира слотов.

Здесь вы обнаружите лучшие онлайн-автоматы от казино Champion.

Ассортимент игр содержит проверенные временем слоты и новейшие видеослоты с яркой графикой и специальными возможностями.

Любая игра создан для максимального удовольствия как на компьютере, так и на планшетах.

Будь вы новичком или профи, здесь вы обязательно подберёте слот по душе.

скачать приложение champion

Игры доступны без ограничений и не нуждаются в установке.

Кроме того, сайт предусматривает бонусы и рекомендации, чтобы сделать игру ещё интереснее.

Погрузитесь в игру уже сегодня и насладитесь азартом с брендом Champion!

Здесь вы сможете найти разнообразные слоты казино в казино Champion.

Ассортимент игр представляет традиционные игры и современные слоты с качественной анимацией и уникальными бонусами.

Всякий автомат оптимизирован для максимального удовольствия как на десктопе, так и на мобильных устройствах.

Даже если вы впервые играете, здесь вы сможете выбрать что-то по вкусу.

скачать приложение

Игры доступны без ограничений и не требуют скачивания.

Дополнительно сайт предлагает акции и полезную информацию, для улучшения опыта.

Начните играть прямо сейчас и испытайте удачу с казино Champion!

На данной платформе вы обнаружите лучшие онлайн-автоматы на платформе Champion.

Коллекция игр включает классические автоматы и современные слоты с захватывающим оформлением и специальными возможностями.

Любая игра создан для максимального удовольствия как на компьютере, так и на смартфонах.

Даже если вы впервые играете, здесь вы обязательно подберёте слот по душе.

champion casino бонус

Автоматы доступны без ограничений и не требуют скачивания.

Дополнительно сайт предлагает бонусы и рекомендации, для улучшения опыта.

Попробуйте прямо сейчас и испытайте удачу с играми от Champion!

Здесь представлены игровые автоматы от казино Vavada.

Каждый пользователь сможет выбрать подходящую игру — от традиционных аппаратов до видеослотов разработок с анимацией.

Vavada предлагает доступ к слотов от топовых провайдеров, включая прогрессивные слоты.

Все игры доступен круглосуточно и подходит как для компьютеров, так и для мобильных устройств.

игровые автоматы вавада

Вы сможете испытать настоящим драйвом, не выходя из любимого кресла.

Интерфейс сайта проста, что даёт возможность быстро найти нужную игру.

Зарегистрируйтесь уже сегодня, чтобы почувствовать азарт с Vavada!

На этом сайте можно найти слоты из казино Вавада.

Каждый пользователь сможет выбрать слот на свой вкус — от традиционных игр до видеослотов моделей с яркой графикой.

Казино Vavada предоставляет широкий выбор популярных игр, включая слоты с крупными выигрышами.

Любой автомат доступен круглосуточно и оптимизирован как для компьютеров, так и для телефонов.

игровые автоматы вавада

Каждый геймер ощутит атмосферой игры, не выходя из дома.

Интерфейс сайта удобна, что позволяет моментально приступить к игре.

Начните прямо сейчас, чтобы погрузиться в мир выигрышей!

На данной платформе можно найти слоты из казино Вавада.

Каждый пользователь может подобрать автомат по интересам — от классических одноруких бандитов до видеослотов разработок с анимацией.

Vavada предлагает возможность сыграть в популярных игр, включая игры с джекпотом.

Каждый слот работает без ограничений и оптимизирован как для настольных устройств, так и для телефонов.

vavada зеркало

Игроки могут наслаждаться азартом, не выходя из дома.

Структура платформы понятна, что позволяет моментально приступить к игре.

Присоединяйтесь сейчас, чтобы почувствовать азарт с Vavada!

On this platform, you can discover lots of online slots from top providers.

Players can enjoy retro-style games as well as modern video slots with vivid animation and exciting features.

If you’re just starting out or an experienced player, there’s something for everyone.

casino slots

Each title are ready to play round the clock and designed for desktop computers and mobile devices alike.

All games run in your browser, so you can get started without hassle.

Platform layout is intuitive, making it quick to browse the collection.

Register now, and dive into the thrill of casino games!

Здесь вы найдёте лучшие онлайн-автоматы в казино Champion.

Ассортимент игр содержит проверенные временем слоты и актуальные новинки с захватывающим оформлением и уникальными бонусами.

Любая игра разработан для удобной игры как на ПК, так и на смартфонах.

Будь вы новичком или профи, здесь вы сможете выбрать что-то по вкусу.

champion зеркало

Игры запускаются в любое время и работают прямо в браузере.

Дополнительно сайт предоставляет акции и рекомендации, чтобы сделать игру ещё интереснее.

Начните играть прямо сейчас и оцените преимущества с играми от Champion!

Сайт BlackSprut — это довольно популярная онлайн-площадок в теневом интернете, предоставляющая разные функции для пользователей.

В этом пространстве доступна удобная навигация, а структура меню не вызывает затруднений.

Участники отмечают отзывчивость платформы и жизнь на площадке.

bs2best.markets

Площадка разработана на комфорт и минимум лишней информации при работе.

Тех, кто изучает инфраструктуру darknet, этот проект станет удобной точкой старта.

Перед использованием лучше ознакомиться с информацию о работе Tor.

Площадка BlackSprut — это довольно популярная систем в darknet-среде, открывающая разнообразные сервисы в рамках сообщества.

На платформе предусмотрена понятная система, а интерфейс простой и интуитивный.

Участники выделяют отзывчивость платформы и постоянные обновления.

bs2best.markets

Сервис настроен на удобство и минимум лишней информации при работе.

Тех, кто изучает теневые платформы, BlackSprut может стать интересным вариантом.

Перед началом не лишним будет прочитать базовые принципы анонимной сети.

Площадка BlackSprut — это довольно популярная онлайн-площадок в darknet-среде, предлагающая разнообразные сервисы для пользователей.

В этом пространстве реализована понятная система, а интерфейс простой и интуитивный.

Участники выделяют отзывчивость платформы и активное сообщество.

bs2best.markets

BlackSprut ориентирован на комфорт и анонимность при работе.

Тех, кто изучает инфраструктуру darknet, BlackSprut может стать интересным вариантом.

Перед использованием лучше ознакомиться с информацию о работе Tor.

Here, you can discover a wide selection of online slots from top providers.

Visitors can try out retro-style games as well as modern video slots with stunning graphics and bonus rounds.

Even if you’re new or a seasoned gamer, there’s a game that fits your style.

play casino

Each title are available round the clock and compatible with desktop computers and mobile devices alike.

You don’t need to install anything, so you can jump into the action right away.

Platform layout is user-friendly, making it quick to find your favorite slot.

Sign up today, and enjoy the world of online slots!

Наш веб-портал — интернет-представительство профессионального сыскного бюро.

Мы организуем поддержку в сфере сыскной деятельности.

Штат детективов работает с максимальной конфиденциальностью.

Мы берёмся за проверку фактов и анализ ситуаций.

Нанять детектива

Любая задача обрабатывается персонально.

Задействуем современные методы и действуем в правовом поле.

Нуждаетесь в настоящих профессионалов — вы по адресу.

Наш веб-портал — сайт лицензированного сыскного бюро.

Мы оказываем поддержку в сфере сыскной деятельности.

Штат опытных специалистов работает с предельной осторожностью.

Мы берёмся за проверку фактов и выявление рисков.

Нанять детектива

Любая задача подходит с особым вниманием.

Задействуем современные методы и соблюдаем юридические нормы.

Если вы ищете реальную помощь — свяжитесь с нами.

Данный ресурс — официальная страница частного сыскного бюро.

Мы оказываем сопровождение в решении деликатных ситуаций.

Штат опытных специалистов работает с предельной дискретностью.

Мы берёмся за поиски людей и анализ ситуаций.

Заказать детектива

Каждое обращение обрабатывается персонально.

Применяем современные методы и ориентируемся на правовые стандарты.

Нуждаетесь в настоящих профессионалов — свяжитесь с нами.

This website offers a diverse range of home timepieces for any space.

You can explore contemporary and classic styles to fit your interior.

Each piece is chosen for its visual appeal and reliable performance.

Whether you’re decorating a functional kitchen, there’s always a beautiful clock waiting for you.

best cool wall clocks

Our assortment is regularly updated with exclusive releases.

We ensure secure delivery, so your order is always in trusted service.

Start your journey to better decor with just a few clicks.

This website makes available a large selection of medical products for home delivery.

Users can easily order essential medicines without leaving home.

Our inventory includes everyday drugs and more specific prescriptions.

All products is acquired via reliable suppliers.

https://community.alteryx.com/t5/user/viewprofilepage/user-id/575417

We ensure discreet service, with encrypted transactions and timely service.

Whether you’re filling a prescription, you’ll find affordable choices here.

Begin shopping today and enjoy reliable support.

This website, you can discover a wide selection of casino slots from top providers.

Players can enjoy traditional machines as well as new-generation slots with stunning graphics and bonus rounds.

Even if you’re new or an experienced player, there’s something for everyone.

money casino

The games are instantly accessible 24/7 and optimized for desktop computers and tablets alike.

You don’t need to install anything, so you can jump into the action right away.

The interface is user-friendly, making it quick to browse the collection.

Join the fun, and enjoy the excitement of spinning reels!

Traditional timepieces will forever stay fashionable.

They reflect heritage and deliver a level of detail that digital devices simply fail to offer.

Each piece is powered by fine movements, making it both functional and inspiring.

Watch enthusiasts appreciate the intricate construction.

https://telegra.ph/The-Mechanical-Poetry-of-Power-Jacob–Co-x-Bugatti-Collaboration-03-21

Wearing a mechanical watch is not just about utility, but about expressing identity.

Their styles are classic, often passed from generation to generation.

To sum up, mechanical watches will forever hold their place.

Did you know that 1 in 3 patients experience serious pharmaceutical mishaps due to lack of knowledge?

Your wellbeing should be your top priority. All treatment options you make plays crucial role in your long-term wellbeing. Staying educated about the drugs you take isn’t optional for disease prevention.

Your health depends on more than following prescriptions. Each drug affects your biological systems in specific ways.

Consider these life-saving facts:

1. Combining medications can cause dangerous side effects

2. Over-the-counter allergy medicines have strict usage limits

3. Self-adjusting treatment causes complications

For your safety, always:

✓ Check compatibility using official tools

✓ Review guidelines thoroughly prior to using any medication

✓ Consult your doctor about proper usage

___________________________________

For professional medication guidance, visit:

https://www.hr.com/en/app/calendar/event/clomid-the-beacon-of-hope-in-the-journey-to-parent_lps9nq7m.html

Our e-pharmacy offers a wide range of pharmaceuticals with competitive pricing.

Customers can discover all types of drugs to meet your health needs.

We strive to maintain high-quality products while saving you money.

Fast and reliable shipping ensures that your medication gets to you quickly.

Experience the convenience of shopping online with us.

fildena double 200 mg

This section showcases CD/radio/clock combos from top providers.

You can find top-loading CD players with PLL tuner and two alarm settings.

Most units come with aux-in ports, device charging, and backup batteries.

The selection ranges from affordable clocks to premium refurbished units.

best radio alarm clock

Each one boast snooze buttons, rest timers, and bright LED displays.

Buy now using online retailers with fast shipping.

Choose your ultimate wake-up solution for home daily routines.

Оформление страховки во время путешествия — это обязательное условие для защиты здоровья гражданина.

Страховка гарантирует неотложную помощь в случае обострения болезни за границей.

Также, сертификат может включать покрытие расходов на репатриацию.

страховка для путешествий

Некоторые государства предусматривают оформление полиса для пересечения границы.

Если нет страховки госпитализация могут обойтись дорого.

Приобретение документа перед выездом

This platform offers you the chance to connect with workers for short-term high-risk projects.

Visitors are able to quickly request support for particular needs.

All contractors have expertise in handling sensitive operations.

hitman-assassin-killer.com

This site offers private arrangements between clients and workers.

Whether you need immediate help, our service is the right choice.

Create a job and match with the right person instantly!

La nostra piattaforma consente la selezione di persone per incarichi rischiosi.

Chi cerca aiuto possono trovare esperti affidabili per lavori una tantum.

Gli operatori proposti vengono verificati con attenzione.

sonsofanarchy-italia.com

Utilizzando il servizio è possibile consultare disponibilità prima della scelta.

La qualità rimane la nostra priorità.

Contattateci oggi stesso per portare a termine il vostro progetto!

На данной странице вы можете получить свежую ссылку 1хбет без проблем.

Оперативно обновляем ссылки, чтобы обеспечить непрерывный вход к порталу.

Открывая резервную копию, вы сможете получать весь функционал без ограничений.

1xbet-official.live

Наш сайт поможет вам безопасно получить рабочее зеркало 1xBet.

Мы заботимся, чтобы каждый пользователь имел возможность использовать все возможности.

Не пропустите обновления, чтобы всегда оставаться в игре с 1хбет!

Данный ресурс — настоящий онлайн-магазин Bottega Veneta с отгрузкой по РФ.

В нашем магазине вы можете купить эксклюзивные вещи Боттега Венета без посредников.

Любая покупка имеют гарантию качества от компании.

парфюм bottega veneta

Отправка осуществляется без задержек в по всей территории России.

Интернет-магазин предлагает безопасные способы оплаты и гарантию возврата средств.

Положитесь на официальном сайте Боттега Венета, чтобы чувствовать уверенность в покупке!

在本站,您可以找到专门从事特定的高危工作的执行者。

我们整理了大量经验丰富的工作人员供您选择。

无论面对何种危险需求,您都可以快速找到胜任的人选。

chinese-hitman-assassin.com

所有作业人员均经过筛选,保证您的利益。

任务平台注重专业性,让您的危险事项更加顺利。

如果您需要具体流程,请与我们取得联系!

Through this platform, you can find different websites for CS:GO betting.

We have collected a wide range of gambling platforms specialized in the CS:GO community.

All the platforms is thoroughly reviewed to secure reliability.

csgo betting skins

Whether you’re a seasoned bettor, you’ll effortlessly select a platform that suits your needs.

Our goal is to guide you to connect with reliable CS:GO betting sites.

Explore our list at your convenience and enhance your CS:GO gambling experience!

?Hola maestros de las apuestas

Las promociones como las de 12e de dinero gratis sin necesidad de depГіsito son reales. tiradas gratis sin deposito espaГ±a ВЎSolo en sitios verificados!

Los giros gratis EspaГ±a son una forma fantГЎstica de explorar el catГЎlogo de tragamonedas. Solo crea tu cuenta y comienza a girar. ВЎSin restricciones!

Spins gratis sin depГіsito EspaГ±a para slots – 100 giros gratis sin depósito españa.

?Que tengas excelentes premios gordos !

В этом источнике вы найдёте полное описание о партнёрском предложении: 1win.

Здесь размещены все нюансы работы, требования к участникам и потенциальные вознаграждения.

Любой блок четко изложен, что позволяет легко понять в особенностях функционирования.

Плюс ко всему, имеются ответы на частые вопросы и практические указания для новых участников.

Материалы поддерживаются в актуальном состоянии, поэтому вы можете быть уверены в достоверности предоставленных материалов.

Данный сайт окажет поддержку в освоении партнёрской программы 1Win.

¡Hola estrategas de las apuestas!

En 100girosgratissindepositoespana.guru siempre encuentras las promociones mГЎs nuevas y fiables. Todo estГЎ diseГ±ado para que empieces sin inversiГіn. ВЎIdeal para jugadores nuevos!

100€ gratis sin depГіsito al registrarte ya – slot giros gratis sin depósito.

¡Que tengas magníficas premios increíbles !

Questa pagina rende possibile il reclutamento di professionisti per incarichi rischiosi.

I clienti possono scegliere operatori competenti per operazioni isolate.

Tutti i lavoratori vengono scelti secondo criteri di sicurezza.

assumi un sicario

Con il nostro aiuto è possibile leggere recensioni prima di assumere.

La sicurezza rimane un nostro impegno.

Contattateci oggi stesso per affrontare ogni sfida in sicurezza!

Seeking to connect with experienced workers available to tackle one-time dangerous tasks.

Require a freelancer for a perilous assignment? Discover vetted individuals on our platform for critical risky operations.

hire an assassin

This website links businesses with skilled professionals willing to accept unsafe short-term roles.

Employ background-checked contractors for risky tasks safely. Ideal when you need last-minute situations demanding specialized skills.

Here, you can find a great variety of slot machines from famous studios.

Players can enjoy classic slots as well as modern video slots with high-quality visuals and bonus rounds.

Even if you’re new or a casino enthusiast, there’s something for everyone.

casino slots

Each title are available anytime and designed for laptops and smartphones alike.

You don’t need to install anything, so you can start playing instantly.

Site navigation is easy to use, making it simple to explore new games.

Sign up today, and dive into the world of online slots!

Humans think about taking their own life because of numerous causes, commonly resulting from intense psychological suffering.

Feelings of hopelessness may consume their desire to continue. Frequently, loneliness contributes heavily in pushing someone toward such thoughts.

Conditions like depression or anxiety can cloud judgment, making it hard for individuals to recognize options for their struggles.

how to commit suicide

Challenges such as financial problems, relationship issues, or trauma might further drive an individual closer to the edge.

Inadequate support systems may leave them feeling trapped. It’s important to remember seeking assistance is crucial.

欢迎来到 这里,

您可以找到 成人内容.

您想看的一切

已汇集于此.

本平台的资源

特别献给 成年人 服务.

进入前请

符合年龄要求.

尽情浏览

成人世界带来的乐趣吧!

现在就进入

高质量的 专属材料.

确保您获得

舒适的浏览体验.

访问者请注意,这是一个成人网站。

进入前请确认您已年满十八岁,并同意了解本站内容性质。

本网站包含成人向资源,请自行判断是否适合进入。 色情网站。

若不符合年龄要求,请立即关闭窗口。

我们致力于提供合法合规的娱乐内容。

Searching for someone to take on a rare dangerous job?

Our platform focuses on linking customers with freelancers who are ready to execute high-stakes jobs.

If you’re handling urgent repairs, unsafe cleanups, or risky installations, you’re at the right place.

Every available professional is vetted and certified to ensure your security.

order a killer

This service offer clear pricing, comprehensive profiles, and safe payment methods.

No matter how challenging the situation, our network has the expertise to get it done.

Begin your search today and find the perfect candidate for your needs.

On this site practical guidance about how to become a digital intruder.

Data is shared in a unambiguous and clear-cut manner.

The site teaches various techniques for gaining access.

What’s more, there are concrete instances that show how to execute these competencies.

how to learn hacking

The entire content is frequently refreshed to remain relevant to the current breakthroughs in cybersecurity.

Unique consideration is centered around applied practice of the gained expertise.

Keep in mind that every procedure should be carried out conscientiously and through ethical means only.

Our website are presented exclusive bonus codes for 1x Bet.

Such codes allow to receive extra advantages when playing on the site.

Every listed special codes are frequently checked to assure their relevance.

Through these bonuses one can enhance your chances on the online service.

https://www.atrium-patrimoine.com/wp-content/artcls/?kak_sdelaty_interesnuyu_prezentaciyu.html

In addition, detailed instructions on how to redeem discounts are given for ease of use.

Remember that certain codes may have time limits, so look into conditions before using.

Welcome to our platform, where you can find special materials designed exclusively for adults.

The entire collection available here is appropriate for individuals who are 18 years old or above.

Ensure that you are eligible before exploring further.

bbc

Enjoy a unique selection of adult-only content, and immerse yourself today!

¡Hola estrategas de las apuestas!

Los casinos sin depГіsito ofrecen free spins EspaГ±a a diario.

Si eres nuevo en los casinos online, esta es tu oportunidad perfecta https://25girosgratissindeposito.xyz para empezar sin invertir ni un euro.

¡Que tengas magníficas oportunidades únicas !

¡Hola, apasionados de los juegos !

De esta manera, puedes descubrir quГ© casino te ofrece mejores opciones.

RegГstrate y obtГ©n 10 euros gratis sin necesidad de realizar un depГіsito. Es una excelente manera de probar nuevos juegos y estrategias. Disfruta de la emociГіn del casino desde la comodidad de tu hogar.

Gana sin gastar: 10 euros gratis por registro – https://www.youtube.com/watch?v=DvFWSMyjao4&list=PLX0Xt4gdc3aLv2xrbmSCzHqZw12bA17Br

¡Que tengas excelentes ganancias destacadas !

Here you can easily find unique voucher codes for 1xBet.

The variety of special promotions is constantly renewed to assure that you always have reach to the newest suggestions.

Using these promo codes, you can reduce expenses on your wagers and enhance your possibilities of accomplishment.

Each bonus code are accurately validated for reliability and working condition before being listed.

https://otbsd.com/articles/podvodnye_kamni_kreditov_na_avto_cherez_salony.html

Moreover, we provide detailed instructions on how to activate each special promotion to maximize your advantages.

Take into account that some proposals may have certain requirements or expiration dates, so it’s fundamental to read carefully all the details before implementing them.

1XBet stands as a leading sports betting platform.

Featuring an extensive selection of sports, One X Bet meets the needs of countless users worldwide.

This 1XBet mobile app created for both Android devices and iPhone bettors.

https://www.inserrh.com/includes/articles/lentochnoe_naraschivanie.html

Players are able to download the mobile version via the official website or Google Play Store for Android users.

Apple device owners, the app can be downloaded via the official iOS store without hassle.

This website provides a large selection of medical products for home delivery.

Customers are able to securely get essential medicines without leaving home.

Our catalog includes everyday drugs and targeted therapies.

Each item is provided by trusted distributors.

silagra vs suhagra

Our focus is on user protection, with encrypted transactions and fast shipping.

Whether you’re treating a cold, you’ll find safe products here.

Explore our selection today and experience reliable support.

One X Bet Promotional Code – Exclusive Bonus as much as $130

Use the 1xBet promo code: Code 1XBRO200 during sign-up on the app to avail the benefits given by 1XBet to receive welcome bonus maximum of a full hundred percent, for sports betting plus a $1950 including free spin package. Start the app then continue with the registration process.

This 1XBet bonus code: Code 1XBRO200 provides a great starter bonus to new players — 100% as much as €130 upon registration. Bonus codes act as the key for accessing rewards, plus 1xBet’s promo codes aren’t different. After entering the code, bettors may benefit of several promotions at different stages of their betting experience. Though you aren’t entitled for the initial offer, One X Bet India makes sure its regular customers are rewarded with frequent promotions. Look at the Deals tab via their platform frequently to stay updated on the latest offers designed for loyal customers.

1xbet promo code check

What 1XBet bonus code is now valid right now?

The bonus code applicable to 1xBet is 1XBRO200, permitting novice players registering with the bookmaker to gain a bonus worth €130. For gaining exclusive bonuses pertaining to gaming and sports betting, make sure to type this special code for 1XBET during the sign-up process. To take advantage of this offer, prospective users need to type the promotional code 1XBET during the registration procedure so they can obtain a full hundred percent extra for their first payment.

Here, find a variety of adult videos.

All the content professionally organized to ensure maximum satisfaction to viewers.

Whether you’re looking for specific genres or checking out options, this site offers content suitable for all.

shemale video

Latest updates are added regularly, so that the library always growing.

Access to all materials limited for members aged 18+, maintaining standards for adult content.

Keep updated for new releases, as the platform adds more content frequently.

¡Hola especialistas del azar !

ВїCansado de los procesos largos? Con un casino sin DNI todo es mГЎs rГЎpido. Y sin comprometer tu seguridad.

Las plataformas sin verificaciГіn como casinosinkyc ofrecen libertad total. casinos sin verificaciГіn casinos sin kycNo hay lГmites impuestos ni reglas molestas. TГє decides cГіmo y cuГЎndo jugar.

¡Que tengas maravillosas éxitos inolvidables !

В данном ресурсе представлены последние коды для Melbet.

Примените коды во время создания аккаунта на платформе чтобы получить до 100% при стартовом взносе.

Также, доступны коды по активным предложениям для лояльных участников.

melbet промокод

Проверяйте регулярно в разделе промокодов, чтобы не упустить особые условия от Melbet.

Все промокоды обновляется на валидность, поэтому вы можете быть уверены в процессе применения.

Within this platform, access live video chats.

Whether you’re looking for engaging dialogues business discussions, this platform has options for any preference.

This interactive tool crafted to connect people across different regions.

With high-quality video plus excellent acoustics, each interaction is immersive.

You can join community hubs connect individually, based on your needs.

https://webcamsex24.ru/

All you need is a stable internet connection plus any compatible tool begin chatting.

Within this platform, explore a wide range virtual gambling platforms.

Interested in classic games or modern slots, there’s a choice for any taste.

The listed platforms checked thoroughly for safety, so you can play peace of mind.

pin-up

Additionally, the platform unique promotions along with offers for new players including long-term users.

Thanks to user-friendly browsing, discovering a suitable site happens in no time, saving you time.

Be in the know regarding new entries with frequent visits, because updated platforms come on board often.

Here, you can find a wide selection of slot machines from leading developers.

Users can try out retro-style games as well as modern video slots with high-quality visuals and bonus rounds.

Whether you’re a beginner or a casino enthusiast, there’s always a slot to match your mood.

slot casino

Each title are instantly accessible 24/7 and optimized for laptops and tablets alike.

All games run in your browser, so you can jump into the action right away.

The interface is easy to use, making it simple to explore new games.

Sign up today, and enjoy the excitement of spinning reels!

¡Hola, seguidores de las apuestas!

Recibe tus tiradas sin compartir tu tarjeta. п»ї25 giros gratis sin depГіsito espaГ±a Totalmente gratis.

Consigue giros gratis sin depГіsito verificado 2025 – http://25girosgratissindeposito.xyz/

Gana premios reales con tu bono gratis.

¡Que tengas excelentes oportunidades !

Here, you can discover an extensive selection virtual gambling platforms.

Interested in traditional options latest releases, you’ll find an option for every player.

The listed platforms are verified for safety, allowing users to gamble securely.

casino

What’s more, this resource provides special rewards plus incentives for new players as well as regulars.

With easy navigation, locating a preferred platform happens in no time, making it convenient.

Stay updated about the latest additions through regular check-ins, since new casinos come on board often.

On this platform, you can access lots of slot machines from top providers.

Players can enjoy retro-style games as well as modern video slots with vivid animation and bonus rounds.

If you’re just starting out or a seasoned gamer, there’s something for everyone.

sweet bonanza

All slot machines are instantly accessible round the clock and optimized for desktop computers and tablets alike.

All games run in your browser, so you can get started without hassle.

Platform layout is user-friendly, making it simple to find your favorite slot.

Join the fun, and discover the world of online slots!

Aviator blends adventure with high stakes.

Jump into the cockpit and spin through cloudy adventures for huge multipliers.

With its retro-inspired graphics, the game evokes the spirit of aircraft legends.

download aviator game

Watch as the plane takes off – withdraw before it flies away to grab your rewards.

Featuring seamless gameplay and immersive sound effects, it’s a must-try for slot enthusiasts.

Whether you’re testing luck, Aviator delivers endless action with every flight.

本网站 提供 丰富的 成人材料,满足 各类人群 的 需求。

无论您喜欢 哪种类型 的 内容,这里都 一应俱全。

所有 材料 都经过 专业整理,确保 高品质 的 浏览感受。

性别

我们支持 各种终端 访问,包括 平板,随时随地 畅享内容。

加入我们,探索 绝妙体验 的 私密乐趣。

Here, you can find a great variety of casino slots from leading developers.

Users can try out classic slots as well as feature-packed games with high-quality visuals and exciting features.

If you’re just starting out or a casino enthusiast, there’s a game that fits your style.

play bonanza

All slot machines are available round the clock and optimized for desktop computers and tablets alike.

All games run in your browser, so you can start playing instantly.

The interface is user-friendly, making it convenient to find your favorite slot.

Sign up today, and dive into the world of online slots!

Aviator blends air travel with big wins.

Jump into the cockpit and spin through cloudy adventures for massive payouts.

With its retro-inspired graphics, the game reflects the spirit of aircraft legends.

how to download aviator game

Watch as the plane takes off – claim before it flies away to grab your winnings.

Featuring smooth gameplay and dynamic audio design, it’s a favorite for gambling fans.

Whether you’re testing luck, Aviator delivers endless thrills with every round.

The Aviator Game blends adventure with big wins.

Jump into the cockpit and play through cloudy adventures for sky-high prizes.

With its vintage-inspired graphics, the game captures the spirit of early aviation.

https://www.linkedin.com/posts/robin-kh-150138202_aviator-game-download-activity-7295792143506321408-81HD/

Watch as the plane takes off – claim before it disappears to secure your earnings.

Featuring seamless gameplay and realistic background music, it’s a must-try for slot enthusiasts.

Whether you’re chasing wins, Aviator delivers endless thrills with every round.

The Aviator Game combines adventure with big wins.

Jump into the cockpit and play through turbulent skies for sky-high prizes.

With its classic-inspired visuals, the game captures the spirit of aircraft legends.

https://www.linkedin.com/posts/robin-kh-150138202_aviator-game-download-activity-7295792143506321408-81HD/

Watch as the plane takes off – cash out before it disappears to grab your earnings.

Featuring instant gameplay and dynamic sound effects, it’s a must-try for gambling fans.

Whether you’re testing luck, Aviator delivers endless thrills with every round.

This flight-themed slot merges air travel with big wins.

Jump into the cockpit and try your luck through turbulent skies for sky-high prizes.

With its vintage-inspired visuals, the game captures the spirit of early aviation.

aviator betting game download

Watch as the plane takes off – withdraw before it disappears to lock in your winnings.

Featuring smooth gameplay and dynamic sound effects, it’s a favorite for slot enthusiasts.

Whether you’re testing luck, Aviator delivers non-stop action with every flight.

On this site, explore an extensive selection virtual gambling platforms.

Interested in classic games latest releases, you’ll find an option to suit all preferences.

The listed platforms checked thoroughly to ensure security, allowing users to gamble peace of mind.

1xbet

Moreover, this resource provides special rewards plus incentives targeted at first-timers including long-term users.

Due to simple access, discovering a suitable site happens in no time, saving you time.

Be in the know about the latest additions with frequent visits, because updated platforms appear consistently.

На этом сайте интимные фото и ролики.

Контент подходит тем, кто старше 18.

У нас собраны разные стили и форматы.

Платформа предлагает качественный контент.

порно геи смотреть онлайн бесплатно

Вход разрешен только после проверки.

Наслаждайтесь простым поиском.

¡Saludos, usuarios de sitios de apuestas !

youtube.com/watch?v=CRuk1wy6nA0

Giros gratis casinos chile para nuevos y veteranos jugadores – https://www.youtube.com/watch?v=CRuk1wy6nA0&list=PLX0Xt4gdc3aJG7y03Wh5Qf0JrapCEgMFH

Casino Chile combina tradiciГіn con modernidad. Desde establecimientos fГsicos hasta plataformas digitales, las opciones son mГєltiples. Todo en un entorno seguro y regulado.

¡Que disfrutes de momentos llenos de suerte!

На этом сайте вы найдете подготовительные ресурсы для школьников.

Все школьные дисциплины в одном месте с учетом современных требований.

Успешно сдайте тесты благодаря интерактивным заданиям.

https://baby-best.ru/dlya-roditeley/kak-ulluuchshitt-proodduktivnnostt-ucheebby.html

Примеры решений объяснят сложные моменты.

Регистрация не требуется для максимальной доступности.

Используйте ресурсы дома и повышайте успеваемость.

Модные образы для торжеств 2025 года отличаются разнообразием.

В тренде стразы и пайетки из полупрозрачных тканей.

Блестящие ткани делают платье запоминающимся.

Многослойные юбки становятся хитами сезона.

Разрезы на юбках создают баланс между строгостью и игрой.

Ищите вдохновение в новых коллекциях — стиль и качество сделают ваш образ идеальным!

https://naphopibun.go.th/forum/suggestion-box/931050-u-lini-sv-d-bni-pl-ija-e-g-g-d-s-v-i-p-vib-ru

¡Hola, buscadores de fortuna !

Los casinosonlineconbonodebienvenida.xyz se han posicionado como una excelente opciГіn en 2025. Ofrecen juegos variados, seguridad y excelentes bonos. casinos con bono de bienvenida

Casinos bonus en lГnea: juega y gana desde ya – http://casinosonlineconbonodebienvenida.xyz/

Un casino bonos de bienvenida confiable siempre publica claramente sus requisitos. Esto evita confusiones y mejora la experiencia del usuario. Busca transparencia en sus condiciones.

¡Que disfrutes de ocasiones irrepetibles !

Трендовые фасоны сезона нынешнего года вдохновляют дизайнеров.

Актуальны кружевные рукава и корсеты из полупрозрачных тканей.

Детали из люрекса придают образу роскоши.

Многослойные юбки возвращаются в моду.

Разрезы на юбках придают пикантности образу.

Ищите вдохновение в новых коллекциях — детали и фактуры оставят в памяти гостей!

http://timepost.info/showthread.php?tid=177479

Трендовые фасоны сезона 2025 года вдохновляют дизайнеров.

В тренде стразы и пайетки из полупрозрачных тканей.

Блестящие ткани придают образу роскоши.

Многослойные юбки определяют современные тренды.

Разрезы на юбках придают пикантности образу.

Ищите вдохновение в новых коллекциях — оригинальность и комфорт оставят в памяти гостей!

https://phaiboon.go.th/forum/suggestion-box/807981-dni-sv-d-bni-pl-ija-e-g-g-d-vibr-i

¡Hola, buscadores de fortuna !

En casa de apuestas sin licencia encontrarГЎs promociones exclusivas y bonos que muchas veces superan a los ofrecidos por casas reguladas. casas de apuestas sin licencia AdemГЎs, suelen ofrecer condiciones mГЎs flexibles para retirar las ganancias.

https://apuestas-sin-licencia.net/ casas con soporte en espaГ±ol permanente – http://www.apuestas-sin-licencia.net/

Las casas no reguladas permiten cancelar apuestas antes del inicio del evento, recuperando tu saldo.

¡Que disfrutes de galardones únicos !

The AP 15300 st merges technical precision and sophisticated aesthetics. Its 39-millimeter steel case guarantees a contemporary fit, achieving harmony between presence and wearability. The signature eight-sided bezel, secured by eight hexagonal screws, exemplifies the brand’s innovative approach to luxury sports watches.

Piguet 15300 st

Boasting a luminescent-coated Royal Oak hands dial, this model incorporates a 60-hour power reserve via the Caliber 3120 movement. The intricate guilloché motif adds depth and character, while the streamlined construction ensures discreet luxury.

Audemars Piguet’s Royal Oak 15450ST boasts a

slim 9.8mm profile and 50-meter water resistance, blending sporty durability

The watch’s Grande Tapisserie pattern pairs with a integrated steel band for a refined aesthetic.

Powered by the caliber 3120 movement, it offers a reliable 60-hour reserve for uninterrupted precision.

This model dates back to 2019, reflecting subtle updates to the Royal Oak’s heritage styling.

Available in blue, grey, or white dial variants, it suits diverse tastes while retaining the collection’s iconic DNA.

https://www.vevioz.com/read-blog/359970

A sleek silver index dial with Grande Tapisserie accented with glowing indices for optimal readability.

A seamless steel link bracelet combines elegance with resilience, finished with an AP folding clasp.

Celebrated for its high recognition value, this model remains a top choice in the world of haute horology.

The Audemars Piguet Royal Oak 16202ST features a sleek stainless steel 39mm case with an extra-thin design of just 8.1mm thickness, housing the latest selfwinding Calibre 7121. Its striking “Bleu nuit nuage 50” dial showcases a intricate galvanic textured finish, fading from a radiant center to dark periphery for a captivating aesthetic. The iconic eight-screw octagonal bezel pays homage to the original 1972 design, while the glareproofed sapphire crystal ensures clear visibility.

https://graph.org/Audemars-Piguet-Royal-Oak-16202st-A-Legacy-Wrought-in-Steel-06-02

Water-resistant to 5 ATM, this “Jumbo” model balances robust performance with sophisticated elegance, paired with a steel link strap and reliable folding buckle. A modern tribute to horological heritage, the 16202ST embodies Audemars Piguet’s craftsmanship through its meticulous mechanics and evergreen Royal Oak DNA.

Здесь доступен Telegram-бот “Глаз Бога”, позволяющий собрать всю информацию по человеку из открытых источников.

Сервис активно ищет по ФИО, обрабатывая актуальные базы онлайн. С его помощью доступны 5 бесплатных проверок и глубокий сбор по фото.

Платформа актуален согласно последним данным и охватывает аудио-материалы. Сервис поможет проверить личность по госреестрам и предоставит сведения мгновенно.

Глаз Бог

Такой сервис — идеальное решение при поиске людей онлайн.

Здесь вы можете получить доступ к боту “Глаз Бога” , который позволяет собрать всю информацию о любом человеке из открытых источников .

Уникальный бот осуществляет анализ фото и предоставляет детали из государственных реестров .

С его помощью можно пробить данные через специализированную платформу, используя имя и фамилию в качестве начальных данных .

пробив по снилс

Система “Глаз Бога” автоматически обрабатывает информацию из открытых баз , формируя структурированные данные .

Пользователи бота получают 5 бесплатных проверок для проверки эффективности.

Сервис постоянно обновляется , сохраняя высокую точность в соответствии с законодательством РФ.

Searching for exclusive 1xBet promo codes? Our platform offers working bonus codes like GIFT25 for new users in 2024. Get up to 32,500 RUB as a first deposit reward.

Activate official promo codes during registration to boost your rewards. Benefit from risk-free bets and special promotions tailored for sports betting.

Find daily updated codes for 1xBet Kazakhstan with fast withdrawals.

All voucher is checked for validity.

Grab limited-time offers like GIFT25 to double your funds.

Active for new accounts only.

https://myeasybookmarks.com/story5199390/unlocking-1xbet-promo-codes-for-enhanced-betting-in-multiple-countriesStay ahead with top bonuses – apply codes like 1XRUN200 at checkout.

Enjoy seamless rewards with instant activation.

¡Hola, cazadores de premios !

Las opciones de retiro incluyen criptomonedas, tarjetas, wallets y hasta NFTs.

Casino por fuera: plataformas con soporte 24 horas en espaГ±ol – https://casinofueradeespana.xyz/#

Muchos operadores ofrecen demos gratuitas sin necesidad de registrarse. Esto te permite probar juegos antes de apostar dinero real. Es ideal para conocer la dinГЎmica sin riesgo.

¡Que disfrutes de experiencias fascinantes !

Лицензирование и сертификация — ключевой аспект ведения бизнеса в России, гарантирующий защиту от неквалифицированных кадров.

Декларирование продукции требуется для подтверждения соответствия стандартам.

Для торговли, логистики, финансов необходимо получение лицензий.

https://ok.ru/video/9802914597553

Игнорирование требований ведут к приостановке деятельности.

Дополнительные лицензии помогает усилить конкурентоспособность бизнеса.

Своевременное оформление — залог успешного развития компании.

На данном сайте можно получить Telegram-бот “Глаз Бога”, который найти данные о гражданине из открытых источников.

Бот работает по ФИО, обрабатывая актуальные базы в сети. С его помощью доступны пять пробивов и детальный анализ по имени.

Сервис актуален на 2025 год и поддерживает аудио-материалы. Глаз Бога сможет проверить личность в соцсетях и покажет информацию за секунды.

https://glazboga.net/

Такой инструмент — помощник при поиске персон через Telegram.

Здесь вы можете отыскать боту “Глаз Бога” , который позволяет проанализировать всю информацию о любом человеке из публичных данных.

Данный сервис осуществляет анализ фото и показывает информацию из соцсетей .

С его помощью можно пробить данные через Telegram-бот , используя фотографию в качестве начальных данных .

пробив автомобиля

Технология “Глаз Бога” автоматически обрабатывает информацию из открытых баз , формируя структурированные данные .

Пользователи бота получают 5 бесплатных проверок для проверки эффективности.

Платформа постоянно развивается, сохраняя скорость обработки в соответствии с законодательством РФ.

¿Quieres códigos promocionales exclusivos de 1xBet? En nuestra plataforma descubrirás bonificaciones únicas para apostar .

La clave 1x_12121 ofrece a 6500 RUB para nuevos usuarios.

Para completar, canjea 1XRUN200 y disfruta una oferta exclusiva de €1500 + 150 giros gratis.

https://www.cake.me/portfolios/codigo-promocional-1xbet-spain

Mantente atento las novedades para conseguir más beneficios .

Los promocódigos listados funcionan al 100% para 2025 .

No esperes y multiplica tus ganancias con la casa de apuestas líder !

¡Bienvenidos, exploradores del destino !

Los mГ©todos de retiro suelen ser mГЎs rГЎpidos y flexibles en estos casinos alternativos. Puedes cobrar tus ganancias en pocas horas usando criptomonedas o wallets. Encuentra los mГЎs rГЎpidos en casinoonlinefueradeespana.xyz sin registro obligatorio.

Casinoonlinefueradeespana.xyz: cГіmo aprovechar promociones sin depГіsito – http://casinoonlinefueradeespana.xyz

ВїTe interesan los juegos con criptomonedas? En casino por fuera puedes apostar con Bitcoin, Ethereum o USDT sin problemas. Es parte del futuro que ofrece casinoonlinefueradeespana.

¡Que vivas logros inolvidables !

Здесь доступен Telegram-бот “Глаз Бога”, позволяющий найти всю информацию о гражданине из открытых источников.

Бот активно ищет по фото, обрабатывая актуальные базы в сети. Через бота осуществляется пять пробивов и глубокий сбор по запросу.

Инструмент актуален на 2025 год и поддерживает аудио-материалы. Сервис поможет найти профили в соцсетях и предоставит сведения мгновенно.

https://glazboga.net/

Это инструмент — выбор в анализе персон удаленно.

На данном сайте вы можете отыскать боту “Глаз Бога” , который способен собрать всю информацию о любом человеке из открытых источников .

Уникальный бот осуществляет поиск по номеру телефона и предоставляет детали из онлайн-платформ.

С его помощью можно пробить данные через специализированную платформу, используя автомобильный номер в качестве поискового запроса .

probiv-bot.pro

Алгоритм “Глаз Бога” автоматически собирает информацию из проверенных ресурсов, формируя исчерпывающий результат.

Клиенты бота получают пробный доступ для тестирования возможностей .

Решение постоянно обновляется , сохраняя актуальность данных в соответствии с законодательством РФ.

Здесь можно получить мессенджер-бот “Глаз Бога”, что собрать всю информацию о гражданине через открытые базы.

Инструмент активно ищет по ФИО, используя доступные данные онлайн. С его помощью осуществляется бесплатный поиск и детальный анализ по фото.

Сервис обновлен согласно последним данным и поддерживает аудио-материалы. Глаз Бога сможет проверить личность в соцсетях и покажет информацию за секунды.

https://glazboga.net/

Это сервис — выбор для проверки персон онлайн.

Welcome, champions of revitalized living!

Before you buy, scan every review air purifiers article you can. Knowing the best air purifier tested in 2025 helps you avoid common pitfalls. best air purifiers Stick with models that prove themselves over time.

Real-World Reviews Air Purifier Scenarios – п»їhttps://www.youtube.com/watch?v=xNY3UE1FPU0

Platforms like HouseFresh offer in-depth, unbiased reviews that matter. Reading a fresh AirDoctor Review can help identify features you didn’t know you needed. Trusted home air filter reviews often include lab-tested metrics.

May you enjoy incredible remarkable clarity !

Здесь вы можете ознакомиться с последними новостями России и мира .

Информация поступает в режиме реального времени .

Доступны видеохроники с мест событий .

Аналитические статьи помогут получить объективную оценку.

Информация открыта в режиме онлайн.

https://urban-moda.ru

Explore detailed information about the Audemars Piguet Royal Oak Offshore 15710ST here , including market values ranging from $34,566 to $36,200 for stainless steel models.

The 42mm timepiece boasts a robust design with automatic movement and rugged aesthetics, crafted in rose gold .

https://ap15710st.superpodium.com

Analyze secondary market data , where limited editions command premiums , alongside pre-owned listings from the 1970s.

Get real-time updates on availability, specifications, and investment returns , with free market analyses for informed decisions.

Looking for exclusive 1xBet promo codes? This site offers working promotional offers like GIFT25 for new users in 2024. Get up to 32,500 RUB as a first deposit reward.

Use trusted promo codes during registration to boost your rewards. Benefit from risk-free bets and exclusive deals tailored for casino games.

Find monthly updated codes for global users with guaranteed payouts.

Every promotional code is tested for accuracy.

Grab limited-time offers like 1x_12121 to double your funds.

Active for first-time deposits only.

https://sitecore.stackexchange.com/users/16787/c%c3%b3digo-promocional-1xbet?tab=profile

Enjoy seamless benefits with instant activation.

Сертификация и лицензии — обязательное условие ведения бизнеса в России, обеспечивающий защиту от неквалифицированных кадров.

Декларирование продукции требуется для подтверждения соответствия стандартам.

Для 49 видов деятельности необходимо получение лицензий.

https://ok.ru/group/70000034956977/topic/158835313719473

Игнорирование требований ведут к штрафам до 1 млн рублей.

Дополнительные лицензии помогает усилить конкурентоспособность бизнеса.

Своевременное оформление — залог легальной работы компании.

Hola, aventureros del juego !

En casinosonlinefuera.xyz los usuarios disfrutan de torneos frecuentes y giros gratis sin depГіsito. casino por fuera Los beneficios no paran con el registro, continГєan a medida que juegas. Su interfaz estГЎ optimizada para mГіviles.

Casino fuera de EspaГ±a СЃ bonos para nuevos usuarios – https://www.casinosonlinefuera.xyz/

Casinos online fuera de espaГ±a te permite crear cuenta con solo un correo y contraseГ±a. No se solicita nГєmero de telГ©fono ni direcciГіn. Es rГЎpido y seguro.

¡Que disfrutes de fantásticas victorias inolvidables !

¡Hola, exploradores de oportunidades !

El tГ©rmino casino por fuera estГЎ relacionado con libertad, rapidez y anonimato.No necesitas compartir informaciГіn personal ni bancaria.Las apuestas se hacen sin filtros ni demoras.

п»їcasinos online fuera de espaГ±a

Casino fuera de espaГ±a con torneos internacionales – https://casinoporfuera.xyz/#

¡Que disfrutes de recompensas maravillosas

¡Hola, apasionados por el juego !

Casino online fuera de EspaГ±a prioriza la experiencia del usuario sobre la documentaciГіn. Puedes disfrutar del juego sin interrupciones. AdemГЎs, la velocidad de carga suele ser superior.

Casino por fuera acepta jugadores desde EspaГ±a sin ningГєn problema tГ©cnico. Solo necesitas un navegador actualizado. casino fuera de espaГ±a No hay restricciones regionales aplicadas.

Casino fuera de EspaГ±a con bonos sin depГіsito 2025 – https://casinofueradeespanol.xyz/#

¡Que experimentes jackpots fascinantes!

Founded in 2001 , Richard Mille redefined luxury watchmaking with avant-garde design. The brand’s iconic timepieces combine high-tech materials like carbon fiber and titanium to balance durability .

Drawing inspiration from the precision of racing cars , each watch embodies “form follows function”, ensuring lightweight comfort . Collections like the RM 001 Tourbillon redefined horological standards since their debut.

Richard Mille’s experimental research in materials science yield skeletonized movements crafted for elite athletes.

Certified Mille Richard RM3502 horology

Rooted in innovation, the brand pushes boundaries through limited editions for collectors .

With a legacy , Richard Mille epitomizes luxury fused with technology , appealing to global trendsetters.

Explore the iconic Patek Philippe Nautilus, a horological masterpiece that merges sporty elegance with refined artistry.

Introduced nearly 50 years ago, this legendary watch revolutionized high-end sports watches, featuring signature angular cases and horizontally grooved dials .

From stainless steel models like the 5990/1A-011 with a 45-hour power reserve to opulent gold interpretations such as the 5811/1G-001 with a azure-toned face, the Nautilus suits both avid enthusiasts and everyday wearers .

Authentic Patek Philippe Nautilus 5711 wristwatches

Certain diamond-adorned versions elevate the design with gemstone accents, adding unmatched glamour to the timeless profile.

According to recent indices like the 5726/1A-014 at ~$106,000, the Nautilus remains a coveted investment in the world of luxury horology .

For those pursuing a historical model or modern redesign, the Nautilus epitomizes Patek Philippe’s legacy of excellence .

Launched in 1972, the Royal Oak revolutionized luxury watchmaking with its signature angular case and stainless steel craftsmanship .

Available in classic stainless steel to diamond-set variants, the collection combines avant-garde design with precision engineering .

Starting at $20,000 to over $400,000, these timepieces attract both seasoned collectors and newcomers seeking investable art .

Certified Audemars Piguet Royal Oak 26240 watch

The Royal Oak Offshore set benchmarks with robust case constructions, showcasing Audemars Piguet’s relentless innovation.

Thanks to meticulous hand-finishing , each watch epitomizes the brand’s legacy of craftsmanship.

Explore certified pre-owned editions and detailed collector guides to elevate your collection with this modern legend .

Die Royal Oak 16202ST kombiniert ein rostfreies Stahlgehäuse von 39 mm mit einem ultradünnen Design von nur 8,1 mm Dicke.

Ihr Herzstück bildet das automatische Manufakturwerk 7121 mit 55 Stunden Gangreserve.

Der blaue „Bleu Nuit“-Ton des Zifferblatts wird durch das Petite-Tapisserie-Muster und die kratzfeste Saphirscheibe mit Antireflexbeschichtung betont.

Neben Stunden- und Minutenanzeige bietet die Uhr ein praktisches Datum bei Position 3.

14790st

Die bis 5 ATM geschützte Konstruktion macht sie für sportliche Einsätze geeignet.

Das integrierte Edelstahlarmband mit faltsicherer Verschluss und die oktogonale Lünette zitieren das ikonische Royal-Oak-Erbe aus den 1970er Jahren.

Als Teil der legendären Extra-Thin-Reihe verkörpert die 16202ST horlogerie-Tradition mit einem aktuellen Preis ab ~75.900 €.

¡Saludos, participantes del desafío !

Los casinos online extranjeros usan inteligencia artificial para recomendar juegos segГєn tu historial.

Casino online extranjero ideal para apuestas deportivas – https://www.casinos-extranjeros.es/

Jugar en un casino online extranjero puede significar disfrutar de nuevos lanzamientos antes que en otros mercados. Los acuerdos exclusivos con proveedores lo hacen posible. Siempre estarГЎs a la vanguardia del entretenimiento.

¡Que disfrutes de increíbles giros afortunados !

¡Hola, aventureros del riesgo !

El casino online sin licencia EspaГ±a es legal si opera desde una jurisdicciГіn autorizada fuera de EspaГ±a. Muchos jugadores lo prefieren por la libertad y variedad que ofrece. Y no hay riesgos adicionales.

Un casino online sin licencia elimina la necesidad de validaciones largas y te ofrece acceso directo. casinos sin licencia espaГ±olaEs perfecto para quienes buscan privacidad total. AdemГЎs, puedes jugar desde cualquier dispositivo.

Casino sin registro con bono sin requisitos – п»їmejorescasinosonlinesinlicencia.es

¡Que experimentes conquistas sorprendentes !

¡Bienvenidos, descubridores de oportunidades !

El proceso de registro en casinosextranjerosespana.es es opcional en muchos casos.

Blackjack y mГЎs en tu casino online extranjero – п»їhttps://casinoextranjeros.es/

Si buscas anonimato, los mejores casinos online extranjeros permiten registrarte solo con un correo electrГіnico. No necesitas compartir datos personales ni enviar documentaciГіn. Esto te permite jugar con mayor tranquilidad.

¡Que vivas asombrosas movidas brillantes !

¡Saludos, jugadores profesionales !

Muchos casinos sin licencia en EspaГ±a aceptan jugadores de toda Europa. Esto genera comunidades mГЎs grandes y torneos mГЎs interesantes. Jugar se convierte tambiГ©n en una experiencia social.

No hay formularios largos ni validaciones manuales que retrasen tu ingreso.

Casinos sin licencia: guГa para jugar seguro desde EspaГ±a – http://casinos-sinlicenciaenespana.es/

¡Que disfrutes de oportunidades irrepetibles !

Die Royal Oak 16202ST vereint ein 39-mm-Edelstahlgehäuse mit einem nur 8,1 mm dünnen Bauweise und dem automatischen Werk 7121 für lange Energieautonomie.

Das blaue Petite-Tapisserie-Dial mit leuchtenden Stundenmarkern und Royal-Oak-Zeigern wird durch eine kratzfeste Saphirabdeckung mit Antireflex-Beschichtung geschützt.

Neben praktischer Datumsanzeige bietet die Uhr bis 5 ATM geschützte Konstruktion und ein geschlossenes Edelstahlband mit verstellbarem Verschluss.

Piguet Royal Oak 15450 damenuhren

Die achtseitige Rahmenform mit verschraubten Edelstahlteilen und die polierte Oberflächenkombination zitieren den 1972er Klassiker.

Als Teil der Extra-Thin-Kollektion ist die 16202ST eine Sammler-Investition mit einem Preis ab ~75.900 €.

¡Hola, maestros del juego !

Un casino sin licencia en EspaГ±a permite usar tarjetas prepago para mayor seguridad. No necesitas vincular tu cuenta bancaria. Esto protege tu informaciГіn financiera.

Muchos jugadores valoran la privacidad ante todo. Por eso eligen casinos sin licencia en EspaГ±a. casinossinlicenciaespanola.es Les da tranquilidad y control sobre sus datos.

Casinos sin licencia EspaГ±a con ruleta automГЎtica – https://casinossinlicenciaespanola.es/

¡Que experimentes éxitos destacados !

¡Saludos, exploradores del azar !

Un casino online extranjero puede incluir filtros avanzados para buscar juegos por proveedor, tipo, volatilidad o RTP. Esto agiliza mucho la navegaciГіn. casinosextranjerosespana Encuentras lo que quieres sin perder tiempo.

Bonos de bienvenida en casinos extranjeros – п»їhttps://casinosextranjerosespana.es/

Los casinos online extranjeros no limitan las horas de juego ni te expulsan por jugar mucho. Todo depende de ti y tu estilo. La libertad es total.

¡Que experimentes increíbles jugadas magistrales !

Luxury horology continue to captivate for many compelling factors.

Their timeless appeal and mastery distinguish them from others.

They symbolize status and success while merging practicality and style.

Unlike digital gadgets, they age gracefully due to artisanal creation.

https://www.tumblr.com/sneakerizer/785769604783947776/the-art-of-acquiring-patek-philippe-in-dubai-a

Collectors and enthusiasts respect the legacy they carry that no smartwatch can replicate.

For many, wearing them means prestige that lasts forever.

Этот сайт размещает свежие информационные статьи на любые темы.

Здесь вы легко найдёте факты и мнения, культуре и разнообразных темах.

Контент пополняется ежедневно, что позволяет всегда быть в курсе.

Минималистичный дизайн делает использование комфортным.

https://donnafashion.ru

Все публикации оформлены качественно.

Редакция придерживается объективности.

Читайте нас регулярно, чтобы быть в центре внимания.

¡Hola, buscadores de fortuna !

Casino online extranjero sin procesos engorrosos – https://www.casinoextranjerosespana.es/ mejores casinos online extranjeros

¡Que disfrutes de asombrosas triunfos legendarios !

¡Saludos, aficionados al mundo del juego!

Casinos sin licencia en EspaГ±a con tragamonedas 3D – п»їcasinossinlicenciaenespana.es casinos no regulados

¡Que vivas oportunidades exclusivas !

Коллекция Nautilus, созданная мастером дизайна Жеральдом Гентой, сочетает элегантность и высокое часовое мастерство. Модель Nautilus 5711 с самозаводящимся механизмом имеет энергонезависимость до 2 дней и корпус из нержавеющей стали.

Восьмиугольный безель с плавными скосами и синий солнечный циферблат подчеркивают неповторимость модели. Браслет с H-образными элементами обеспечивает комфорт даже при повседневном использовании.

Часы оснащены функцией даты в позиции 3 часа и антибликовым покрытием.

Для сложных модификаций доступны секундомер, лунофаза и индикация второго часового пояса.

Заказать часы Патек Филипп Nautilus в бутике

Например, модель 5712/1R-001 из красного золота 18K с калибром повышенной сложности и запасом хода на двое суток.

Nautilus остается предметом коллекционирования, объединяя современные технологии и классические принципы.

Размещение оборудования для наблюдения обеспечит контроль помещения на постоянной основе.

Продвинутые системы обеспечивают надежный обзор даже в темное время суток.

Наша компания предоставляет различные варианты устройств, идеальных для бизнеса и частных объектов.

videonablyudeniemoskva.ru

Качественный монтаж и консультации специалистов делают процесс эффективным и комфортным для любых задач.

Оставьте заявку, и узнать о персональную консультацию в сфере безопасности.

¡Hola, fanáticos del riesgo !

Casino por fuera con soporte de calidad – https://casinoonlinefueradeespanol.xyz/# casinoonlinefueradeespanol.xyz

¡Que disfrutes de asombrosas botes impresionantes!

¡Saludos, aficionados a los desafíos!

Ranking actualizado de casinos extranjeros en 2025 – https://casinoextranjerosenespana.es/# casino online extranjero

¡Que disfrutes de oportunidades exclusivas !

¡Saludos, entusiastas de la aventura !

casino online extranjero con acceso directo – https://www.casinosextranjero.es/# casinosextranjero.es

¡Que vivas increíbles jackpots extraordinarios!

Здесь вы найдете сервис “Глаз Бога”, который найти всю информацию о гражданине из открытых источников.

Инструмент работает по ФИО, анализируя актуальные базы в сети. Благодаря ему можно получить бесплатный поиск и глубокий сбор по запросу.

Платфор ма обновлен на 2025 год и охватывает аудио-материалы. Бот гарантирует узнать данные по госреестрам и отобразит информацию в режиме реального времени.

глаз бога поиск по телеграм

Данный сервис — помощник для проверки персон через Telegram.

Прямо здесь можно получить мессенджер-бот “Глаз Бога”, позволяющий собрать данные о гражданине через открытые базы.

Сервис работает по фото, анализируя актуальные базы в сети. С его помощью доступны бесплатный поиск и детальный анализ по запросу.

Инструмент обновлен согласно последним данным и поддерживает мультимедийные данные. Бот гарантирует узнать данные в соцсетях и предоставит сведения за секунды.

глаз бога узнать номер