Home builders have been ramping up their land holdings and doing so in a way that protects them in the event of a downturn. This is exactly what we suggest in the High Risk, High Reward part of the housing cycle.

Here are some stats on de-risking their growth:

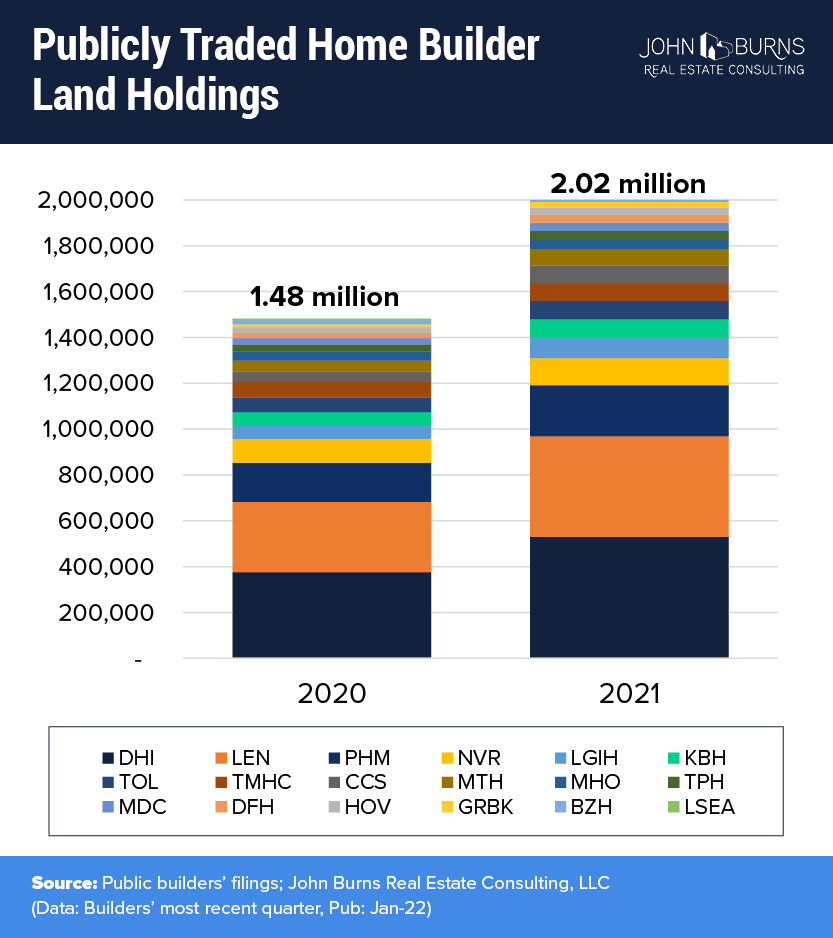

Massive land investment

Public home builder lot control has grown 36% in the last year, to 2.02 million lots owned and controlled.

All 18 public home builders control more lots than one year ago.

De-Risking of ownership

15 of the 18 builders own a smaller % of the lots than they owned one year ago.

3 of the 18 builders even own less than 25% of the lots they control, led by NVR which owns none of the lots.

Builders control land without owning the land two primary ways

- Option agreements: The landowner (often a farmer) agrees to be paid a quarterly fee to continue owning the land until the builder is ready to start construction. This often includes a period when the builder is processing development rights through the local municipality.

- Land banking agreements: A large financial institution agrees to purchase the land and be paid a fee to own the land until the builder is ready to acquire the lots and build a home. This agreement usually involves a very large non-refundable deposit by the builder and an agreement to develop the land using money funded by the large financial institution.

These agreements align the financial interests of all parties:

- Home builder shareholders desire to maximize the return on their invested capital, while having certainty that they will have the land they need.

- Long term landowners like farmers desire to maximize their net worth and are less interested in the time required to do so.

- Land banking financial institutions are looking for a good risk-adjusted yield on their investment. In today’s low yield environment, money has been flowing into the land banking business. Our consulting team has developed processes to help these groups conduct their due diligence quickly and efficiently. Their businesses are expanding to help private builders as well as companies that are developing rental home communities.

If you’ve decided 2022 is the year to take a leap into investment real estate or you’re looking to diversify & income and yield to your long-term investment let us do all the heavy lifting and enjoy an ownership position in a portfolio of cash flowing assets by investing with us @ https://hiscapitalgroup.com/fund3

Make informed real estate investment decisions, the profitable investor is the knowledgeable one Enjoy our Education Center

Source: John Burns Real Estate Consulting, LLC

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!