A recent on-line survey conducted by the American College of Financial services was done to assess the retirement literacy among those at or near retirement. Respondents were between the ages of 60 and 75 with at least $100k in household assets not including their primary residence. To be completely honest as someone in the survey age range, the results weren’t too surprising, reflecting an alarming lack of knowledge in several critical areas.

My parents were the epitome of blue collar & worked hard to build a nice life for their 6 children, but one thing was certain there were rarely any conversations about money at the dinner table other than what I had to do to earn my allowance. Financial basics were not taught in schools then or now, although, I do remember being taught how to balance a checkbook in Home Economics class. However, things were different for those in my parents’ era and a good part of mine. There was a time when you would happily work for one company for your working life, retire at 63 or 65 with a decent pension heck maybe even a gold watch. They even believed that trusting the Gods of Wall Street with their money simply because that’s what we did. That’s not the case any longer, is it? Today we’ve information at our fingertips yet most are still financially illiterate.

The participants of the survey represented a large cross section of Americana and averaged a score of 47%, with 74% of the participants failing!! In fact, only 5% earned higher than a C. Overall, there was a significant lack of knowledge on how basic market instruments perform. Finally, the gender divide which is starting to shift showed that:

- Women did significantly worse on the retirement income planning literacy quiz. • Women showed lower levels of self-perceived knowledge. • Women were more likely to identify as cautious or risk averse than male respondents. • Women showed more conservative answers to investment questions. • Women were far more concerned about retirement risks than men, especially cuts to Social Security. • Women respondents were less likely to do internet searches to look up financial information. • There were low levels of literacy impacting decision making by women, which could be negatively impacting their retirement security.

Thankfully, that trend is now reversing.

Let’s take a look at some major areas of concern:

Sustaining income and the preservation of assets: understanding the importance of these concepts proved frighteningly low. Only 34% realized that negative returns on assets at retirement age would have far greater impact than if those losses were sustained prior to. Meaning they failed to realize they had no time or income to make up for losses. 50% underestimated the life expectancy of a 65-year-old. Less than half knew the predictability of annuities or other residual income streams could offer a hedge against the uncertainty of life expectancy.

Long-term Care: underestimating the need for assistance with “daily living”. Less than 20% of respondents were aware that 70% of the population will require such assistance. Only 33% knew Medicaid pays for most long-term care expenses provided by Nursing homes rather than Medicare and only a third knew that family members provide the majority of long-term care services!

Alternative Investments: 74% responded that having a guaranteed lifetime income in retirement is important, yet only 19% were knowledgeable or aware of alternative investments that provide predictable returns. That includes annuities and real estate funds.

Individual retirement accounts: as a whole survey participants displayed moderate knowledge about IRA’s. However, only 30% could identify the best time to convert from a traditional IRA to a Roth IRA. (By the way, the ideal time is when your tax rate is lower than normal for a given year).

Social Security (or Insecurity pending your perspective): though it’s a staple for many, alarmingly most did not know when to claim it. Only 33% understood that it would be more effective to work two years longer or defer social security for two years rather than increasing their contributions by 3% 5 years prior to retirement.

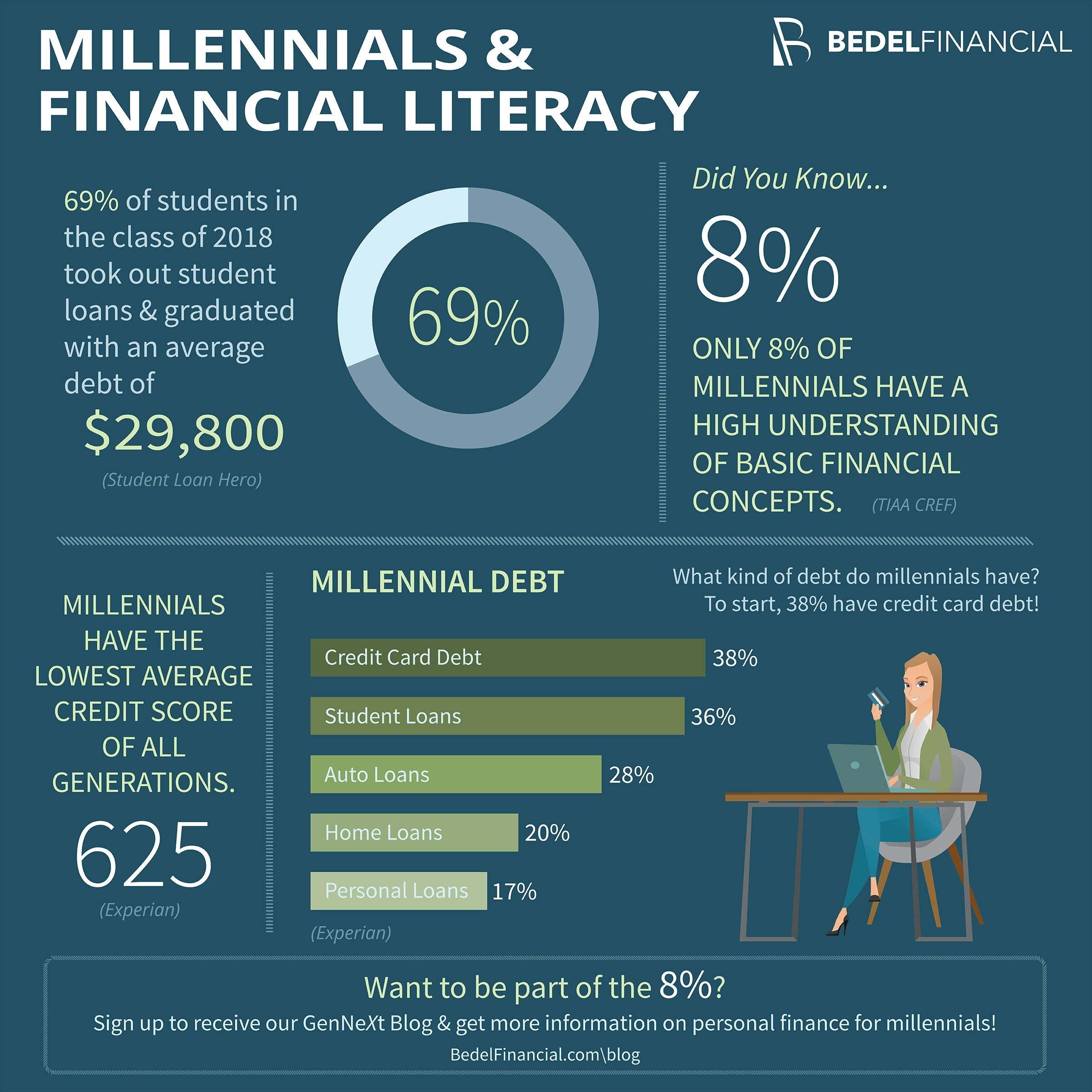

While there is not much hope for my generation, millennials may face a harsher reality. As the graphic below reveals, this troubling trend continues to grow, and many appear headed for a painful ride through life.

There is certainly still time for this age group to “get on the ball” and a host of resources to help them through, contrary to the elder generation.

If you’re seeking a tangible and less volatile investment to offset the volatile nature of Wall Street, you may enjoy the benefits of turn-key investing offered by our Fund 3. An ownership position in a portfolio of assets formerly available only to sophisticated investors is now open for the everyday investor. We’ve changed the game and leveled the playing field, and it doesn’t require your life savings to get started. Check it out here www.hisfund3.com

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?